4 Stages Of Anti Money Laundering

Partial transposition measures. Placement is the first stage of money.

Aml Introduction Stages Of Money Laundering Learn With Flip Youtube

Money Laundering Stages Defined.

4 stages of anti money laundering. AML Program 2 31 Internal policies procedures and controls 2 311. This is done so that they can get rid of the cash that is derived from criminal sources. Knowing New Customers 4 ii.

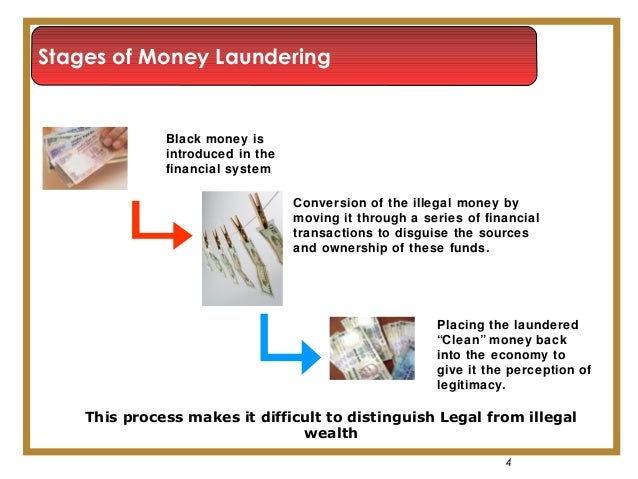

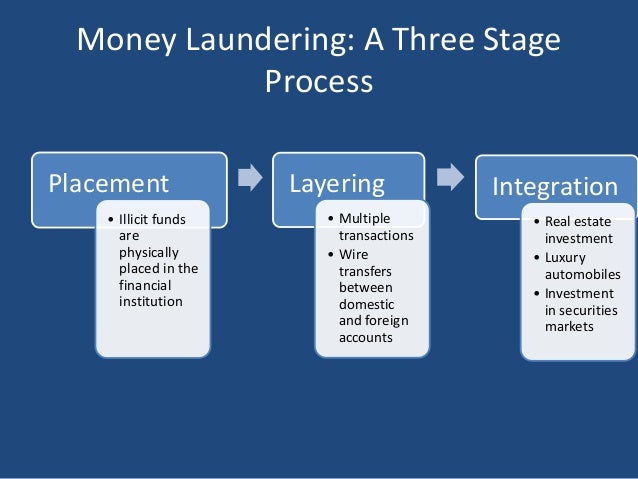

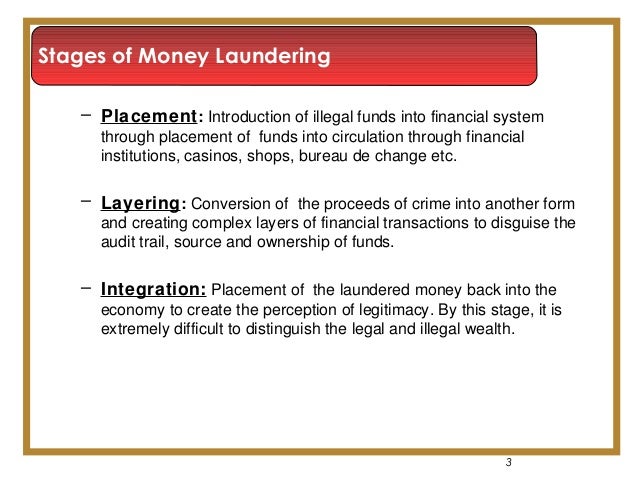

Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. There are three primary stages in a money laundering operation with each stage being marked by a higher complexity and a more significant pool of money.

Here are some of the most common ways this is achieved. Placement layering and integration. Knowing Existing Customers 4 313.

Placement The first stage of money laundering is when the individual participating in criminal activity places cash proceeds into the financial system. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. In the first stage money enters the banking system.

Second phase involves mixing the funds. However it is important to remember that money laundering is a single process. In the third stage money flows back to the.

It can be unsafe for people to hold onto a large amount of cash at one time so they may try to dump the cash somewhere that provides greater security. Generally speaking the money laundering process consists of three stages. The money laundering cycle can be broken down into three distinct stages.

There are 3 stages of money laundering. These are called methods of laundering. Money laundering typically includes three stages.

When should KYC be done. There are usually two or three phases to the laundering. 5 May 2021 Author.

The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Todays package consists of 4 legislative proposals. Stage 1 of Money Laundering.

The money laundering process most commonly occurs in three key stages. KYC and Risk Profile of the Customer 5. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc.

Each individual money laundering stage can be extremely complex due to the criminal activity involved. 1 placement 2 layering and 3 integration. There are three stages involved in money laundering.

Investing in real estate. Money laundering typically includes three stages. Money laundering is the participation in any transaction that seeks to conceal or disguise the nature or origin of funds derived from illegal activities such as fraud corruption organized crime or terrorism etc.

Tips To Streamline Anti Money Laundering Customer Due Diligence Verify identity before doing business Verifying the identity of a client before entering into a business relationship means you start off knowing that you can trust they are who they say they are. Anti Money Laundering programme for Insurers Sl. Financial Stability Financial Services and Capital Markets Union.

Know Your Customer KYC 2 312. AMLA the new EU Anti-money laundering Authority. Placement layering and integration stage.

What is Money Laundering. Banking and financial services. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards.

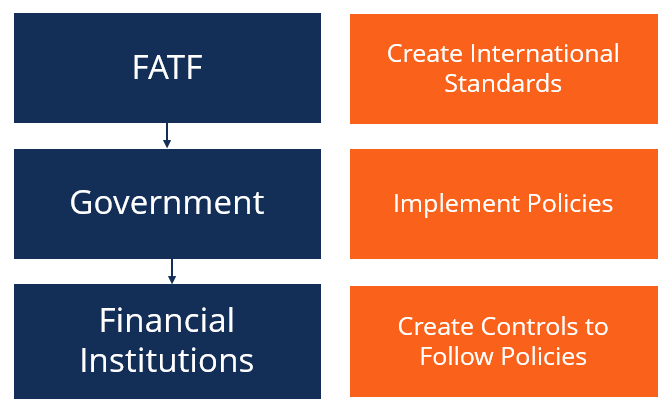

A new EU AML Authority AMLA At the heart of todays legislative package is the creation of a new EU authority that will transform AMLCFT supervision in the EU and enhance cooperation among financial intelligence units FIUs. It will be the central authority coordinating. Paragraph 416 of the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism issued by the Securities and Futures Commission SFC Guideline for the definition of customer for the securities futures and leveraged foreign exchange businesses as well as paragraphs 713 and 714 of the SFC Guideline in identifying suspicious transactions for the securities futures and leveraged.

Investing in other legitimate business interests. 05 October 2020 last update on. It is important to mix the funds from illegal sources with legalIt is relatively very difficult to detect money laundering at this stage.

Money laundering has one purpose. This stage is termed as placement. Placement layering and integration.

The stages of money laundering include the. Money laundering is often comprised of a number of stages including. Placement layering and integration stage.

What are the Three Stages of Money Laundering. Anti-money laundering directive IV AMLD IV - transposition status.

Insurance Anti Money Laundering

What Are The Three Stages Of Money Laundering

Aml Screening How It Might Infiltrate Your Business

Money Laundering Stages Methods Study Com

Money Laundering Video Presentation Youtube

Anti Money Laundering Overview Process And History

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Stages Of Money Laundering Https Tinyurl Com Tdxavfc Socialbookmarking Seo Backlinks Onlinemarketing Influen Money Laundering Social Bookmarking Money

Anti Money Laundering Overview Process And History

Stages In Money Laundering Prevention Anti Money Laundering Ppt

An Introduction To The 360 Degree Aml Investigation Model Acams Today

Basics Of Anti Money Laundering A Really Quick Primer

The Phases Of Money Laundering Download Scientific Diagram

Voluntary Good Practices Guidance For Lawyers To Detect And Combat Money Laundering And Terrorist Financing Resources The American College Of Trust And Estate Counsel

Insurance Anti Money Laundering

Post a Comment for "4 Stages Of Anti Money Laundering"