Define Money Laundering In Banking

Placement is the depositing of funds in financial institutions or the conversion of cash into negotiable instruments. For the purposes of my presentation today I shall define money laundering as the method of hiding mixing and disguising the proceeds of criminal activities through legally operating institutions for the purpose of destroying the origins of the proceeds.

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it.

Define money laundering in banking. Money laundering involves breaking up large amounts of cash into smaller transactions changing its form through investments or deposits into bank accounts and moving the money through seemingly legitimate businesses to bring it. Placement layering and integration. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate.

Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. Money Laundering Disguising the source of money generated through illegal activities so that it resembles legitimate income. Money laundering usually consists of three steps.

Money Laundering is the process of changing the colors of the money. Money laundering is the process of making illegally obtained funds dirty money appear legal. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today.

Money laundering is the process of making illegally. EU legal framework on anti-money laundering and countering the financing of terrorism. Before proceeds of crime are laundered it is problematic for criminals to use the illicit money because they cannot explain where it came from and it is easier to trace it back to the crime.

The dirty money is often moved around to create confusion through wire transfers to. Define Money Laundering Laws. Mr Chairman it is clear from the definition that money laundering is a tool that is used by people.

The illegal funds are first introduced into the legitimate financial system to hide their real source. Define what money laundering is. Along with some other aspects of underground economic activity rough estimates have been.

Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Its very easy to define but involves multiple techniques. Money Laundering is the process of changing the colors of the money.

A number of activities other than the sale of illegal drugs feed the money laundering. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Placement is the most difficult step.

Money Laundering is an act of act of disguising the illegal source of income. It is essential that gatekeepers banks and other obliged entities apply measures to prevent money laundering and terrorist financing. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as the processing of criminal proceeds to disguise their illegal origin in order to legitimize the ill-gotten gains of crime.

Traceability of financial information has an important deterrent effect. Money laundering is the process of disguising the proceeds of crime and integrating it into the legitimate financial system. Define money laundering in banking.

By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

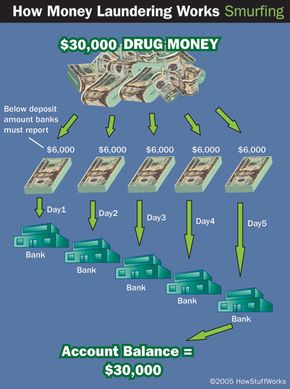

How Money Laundering Works Howstuffworks

Anti Money Laundering Overview Process And History

Money Laundering Overview How It Works Example

Money Laundering Ring Around The White Collar

Pdf Eu Anti Money Laundering Regime An Assessment Within International And National Scenarios

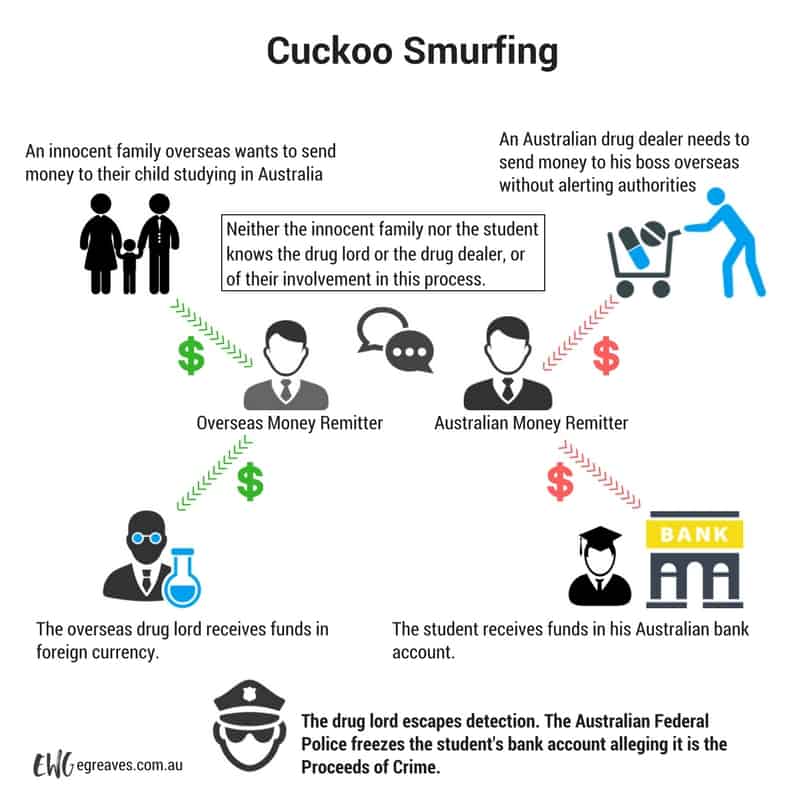

Cuckoo Smurfing Explaining A Money Laundering Methodology

What Is Money Laundering Three Methods Or Stages In Money Laundering

6amld 22 Predicate Offenses For Money Laundering Complyadvantage

What Is Anti Money Laundering Aml Anti Money Laundering

Money Laundering Define Motive Methods Danger Magnitude Control

How Money Laundering Works Howstuffworks

What Is Money Laundering And How Is It Done

What Is Anti Money Laundering Quora

Cryptocurrency Money Laundering Explained Bitquery

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

Trade Based Money Laundering Gao Report Stresses Enforcement Challenges Money Laundering Watch

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

Post a Comment for "Define Money Laundering In Banking"