Know Your Customer Guidelines Anti Money Laundering Standards

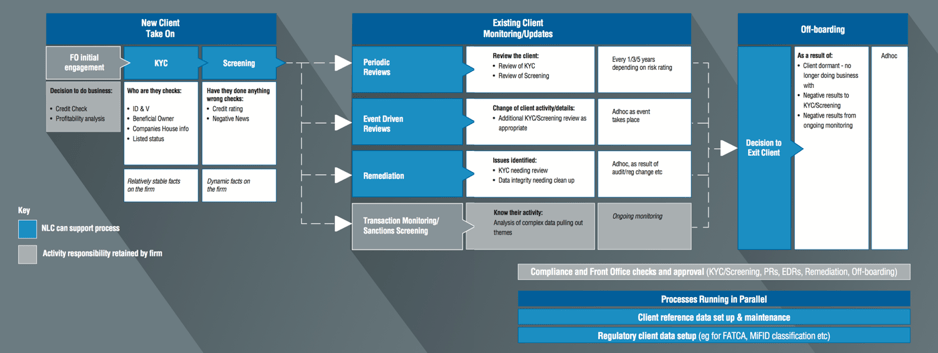

Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of. Version 3 October 30 2017 1 KNOW YOUR CUSTOMER KYC POLICY AS PER ANTI MONEY LAUNDERING STANDARDS IIFL WEALTH FINANCE LIMITED hereinafter referred to as IIFLW Financethe Company in compliance with the Reserve Bank of.

Open Banking Between Anti Money Laundering And Customer Experience

The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose.

Know your customer guidelines anti money laundering standards. Any organisation that does business internationally also needs. On Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. This pressure manifests itself as Know Your Customer KYC regulation as well as various Anti-Money Laundering AML directives.

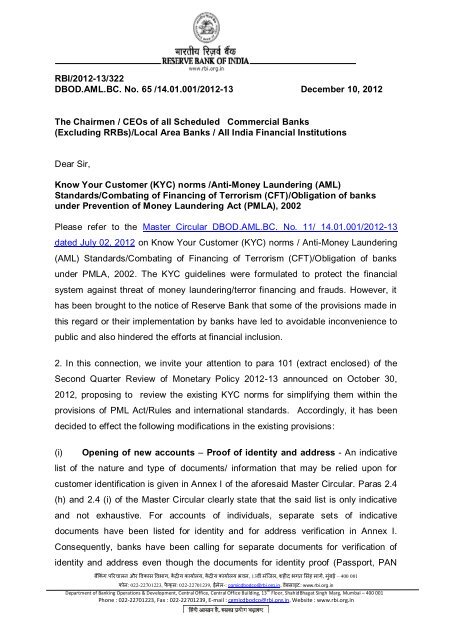

The policy was to lay down the systems and procedures to help control financial frauds identify money laundering and suspicious transactions combating financing of. The Know Your Customer guidelines were issued in February 2005 revisiting the earlier guidelines issued in January 2004 in the context of the Recommendations made by the Financial Action Task Force FATF on Anti Money Laundering AML standards and on Combating Financing of Terrorism CFT. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms.

Reserve Bank of India RBI has issued guidelines on Know Your Customer KYC Guidelines Anti Money Laundering Standards for Non Banking Finance Companies NBFCs thereby setting standards for prevention of money laundering activities and corporate practices while dealing with their customers. Guidelines on Know Your Customer KYC norms and anti-money laundering are presently not applicable to us. Adhere to the guidelines issued by RBI in terms of Prevention of MoneyLaundering Act 2002 the Prevention of MoneyLaundering Maintenance of Records Rules 2005.

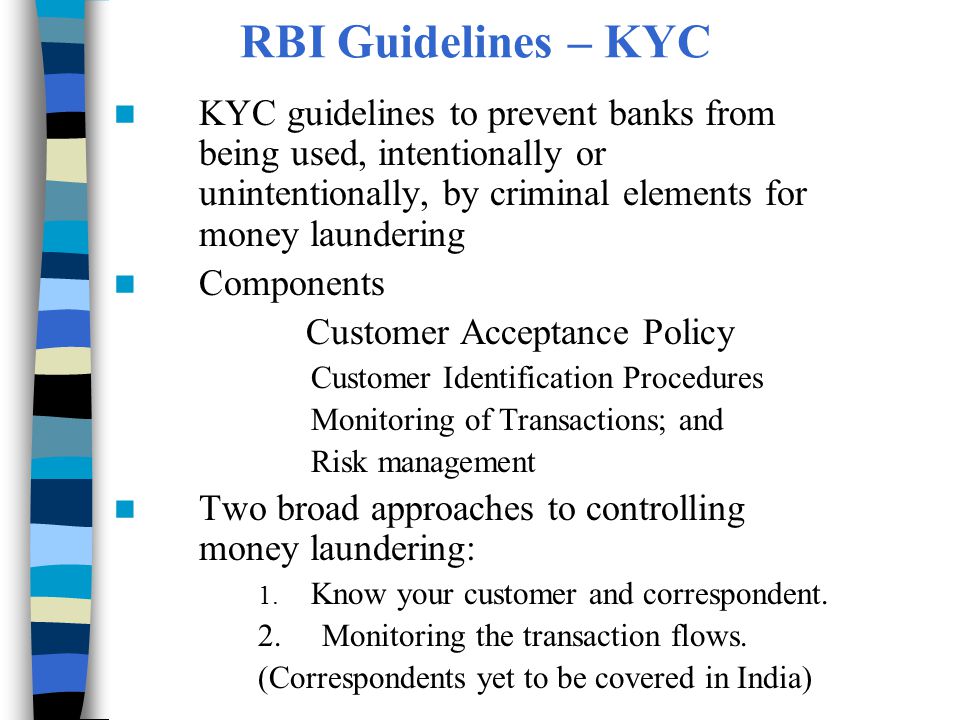

Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Know Your Customer Standards o The objective of the KYC guidelines is to prevent brokers from being used intentionally or unintentionally by criminal elements for money laundering. Please rollover map to select your region then click to select country of choice Anti-Money Laundering Record-breaking fines issued by regulators worldwide notably in the US and UK dominated the financial services landscape in 2012.

Assigned to them in Clause 31 of the Guidelines on Know Your Customer Anti-Money Laundering Measures for Housing Finance Companies as issued by the National Housing Bank in the NHB NDDRSPolicy Circular No942018-19 dated March 11 2019 including any amendments thereto. Know Your Customer KYC Guidelines Anti Money Laundering Standards The Know Your Customer guidelines were issued in February 2005 revisiting the earlier guidelines issued in January 2004 in the context of the Recommendations made by the Financial Action Task Force FATF on Anti Money Laundering AML standards and on Combating Financing of Terrorism CFT. You must document the customer identification procedures you use for different types of customers.

The guidelines on Know Your Customer KYC and Anti Money Laundering AML Measures for the regulated entities including the housing finance companies for setting the standards for prevention of money laundering activities and corporate practices while dealing with their Customers. The objective of KYC guidelines. While specific legislation varies from region to region core compliance requirements are fairly uniform across the international business environment under the FATF requirements and recommendations.

Know Your Customer Guidelines and AntiMoney Laundering Standards The objective of the KYC Guidelines is to. However the Company endeavors to frame a proper policy framework on Know Your Customer KYC and Anti-Money Laundering as per RBI guidelines. These Know Your Customer KYC guidelines have been revisited in the context of the recommendations made by the Financial Action Task Force FATF on Anti Money Laundering AML standards and on Combating Financing of Terrorism CFT.

This looks set to continue in. The Board of Directors and the management team of the Company are responsible for the implementation of the KYC norms. In compliance with the Circular issued by the RBI regarding Know Your Customer guidelines Anti-Money Laundering Standards to be followed by all NBFCs the following KYC PMLA policy of the company has been adopted by the Board of Directors of the company at the board meeting held on 21st April 2010The same is being amended in line with RBI regulations issued from time to time.

Know Your Customer Standards 1. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD.

Kyc Norms Anti Money Laundering Caalley Com

Know Your Customer In Fintech Paytah

Iibf Seminar On Anti Money Laundering Know Your Customer Lucknow 14th September 2006 Vasant Godse Ppt Download

Key Regulatory Issues Arising From Banking Beyond Branches Note Aml Download Scientific Diagram

Anti Money Laundering Aml Learnings From Banks Ppt Video Online Download

Know Your Customer And Anti Money Laundering Measures Ing

Know Your Customer Kyc The Otc Space

Know Your Customer Kyc Process Guide For Banking

Open Banking Between Anti Money Laundering And Customer Experience

Why We Have Kyc As Anti Money Laundering Strategy In Place By Shani Koren Neufund

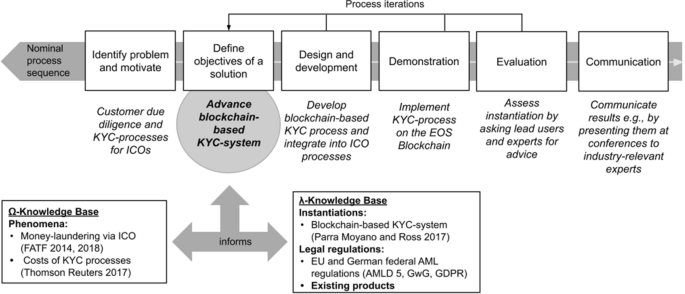

Know Your Customer Kyc Requirements For Initial Coin Offerings Springerlink

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto

Difference Between Kyc And Aml Tookitaki Tookitaki

Kyc Aml As New Regulatory Standards In Icos By Geneos Official Geneos Medium

What Is Kyc Know Your Customer And Aml Anti Money Laundering Mobbeel

Know Your Customer Kyc Process Guide For Banking Bpi The Destination For Everything Process Related

Post a Comment for "Know Your Customer Guidelines Anti Money Laundering Standards"