Money Market Placement Meaning

A public offering would typically involve registering with the Securities and Exchange. The money market is a component of the economy which provides short-term funds.

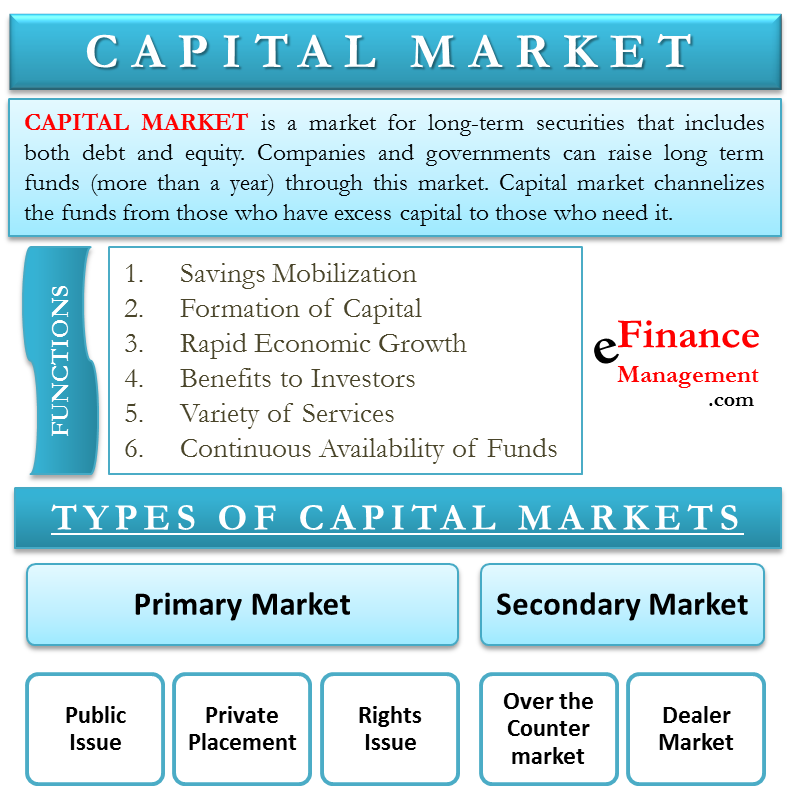

Capital Market Its Meaning And Components Tutor S Tips

Or we can say that for less than a year.

/149820145-5bfc2b9646e0fb00265bec9f.jpg)

Money market placement meaning. The private placement investor demonstrates a constant appetite for private placement debt throughout market cycles and the calendar year. The short term instruments are highly liquid easily marketable with little change of loss. It is through the money market that the central banks are in a position to control the banking system and thereby influence commerce and industry.

Money market makes it easier to transfer various funds from different sector to sector and place to place these facilities of the money market helps in increasing the financial mobility of the country. Upvote 0 Downvote 0 Reply 0. The money market deals in short-term loans generally for a period of a year or less.

These instruments usually are traded. Ultimately it is most important to find a private placement investor who can offer financing best fitted for the goals of. Secure investments offered at fixed or floating rates.

Examples of money market are T-Bills commercial papers repurchase agreements etc. Money Market Placement of Deposits The money market is used by ABC treasury as a means for borrowing and lending in the short term from several days to just under a year. Money market securities consist of certificates of deposit CDs bankers acceptances Treasury bills commercial paper and repurchase agreements repos.

Simply to any suitable buyers who can be found. The advantage of a placing is that it is a cheap and simple method of raising money. Helps in Financial Mobility.

Concepts and meanings of money market Meaning of money market Money or monetary market is the set of financial markets normally to the wholesale independent but related that are exchanged financial assets that have as common denominator a short repayment term which usually does not exceed eighteen months low risk and high liquidity. Our money market placements are a great option for businesses looking to grow their cash reserves. Money market instruments are debt securities that generally give the owner the unconditional right to receive a stated fixed sum of money on a specified date.

It is a product of the capital market which is treated as a channel of short-term debt capital. The money market is a market for short-term instruments that are close substitutes for money. Presently the Money Market placement service is only available to our Correspondent Banking Relationships.

It enables governments banks and other large institutions to sell short-term securities Public Securities Public securities or marketable securities are investments that are openly or easily traded in a market. Meaning and Features of Money Market. AfrAsia Corporate Banking offers short medium and long-term deposits at competitive rates.

They follow through on their commitments. Money Market usually means lending and borrowing for a shorter period of time. Money market basically refers to a section of the financial market where financial instruments with high liquidity and short-term maturities are traded.

The money market is an organized exchange market where participants can lend and borrow short-term high-quality debt securities with average maturities of one year or less. Guaranty Trust Bank UK Limited offers short to medium term placements in GBP USD and EUR to existing counterparties at very competitive rates for investment purposes or to manage the organisations liquidity. Unlike a rights issue a placing of shares is not an offer to existing shareholders.

Ideal for improving liquidity or yields depending upon your requirements. A placing called a placement in the US is the issue of new securities which are sold directly to holders usually institutions. Placement refers to the sale of securities to a group of investors either on a public or private level.

It is concerned with that portion of the financial system where trading of the short-term fund is done for a period of less than 1 year. Money Market acts as an essential part of economic development.

Economics In Plain English Loanable Funds Vs Money Market What S The Difference

:max_bytes(150000):strip_icc()/stock-market-down-56a6d24a5f9b58b7d0e4f823.png)

Essentials Of Financial Markets

What Is A Money Market Fund Forbes Advisor

Economics In Plain English Loanable Funds Vs Money Market What S The Difference

What Are Capital Markets Functions Types Primary Secondary Efm

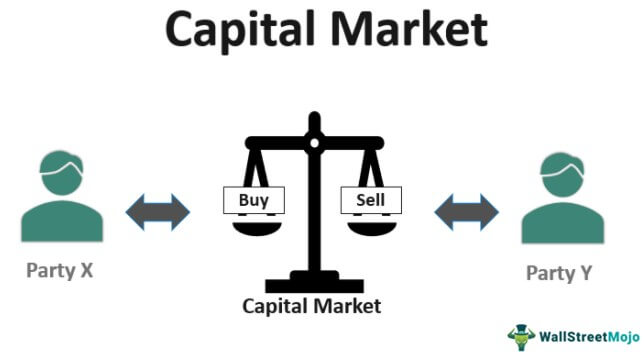

Capital Market Meaning Instruments Example How It Works

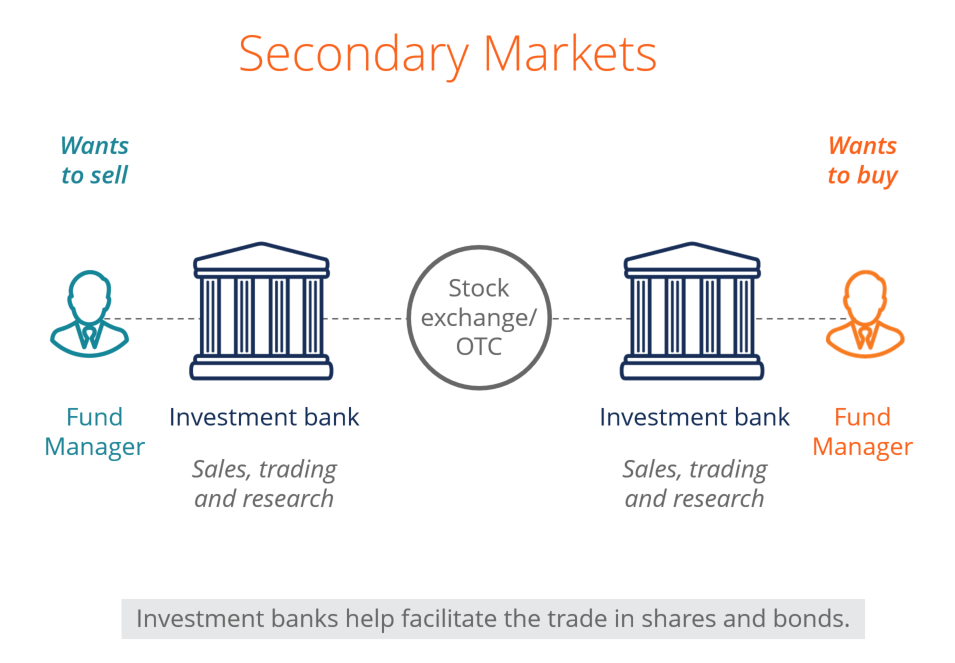

Primary Market How New Securities Are Issued To The Public

The Pros And Cons Of Money Market Accounts Forbes Advisor

Money Market Learn About Money Market Instruments And Functions

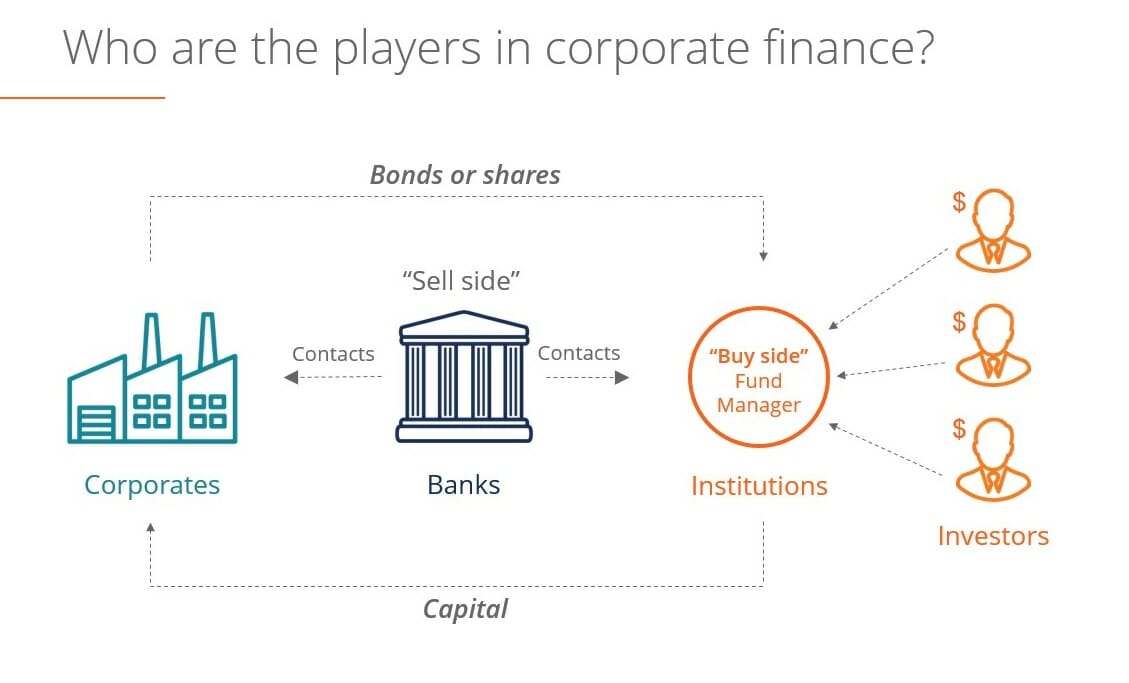

Buy Side Vs Sell Side Important Similarities Differences To Know

Money Market Learn About Money Market Instruments And Functions

/GettyImages-1026036218-b6cd4a72f005410eb149bf00093ce1ed.jpg)

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

/investing9-5bfc2b8d46e0fb0051bddfee.jpg)

:max_bytes(150000):strip_icc()/istock_000024848863_medium-5bfc3b9946e0fb0051801a1b.jpg)

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Post a Comment for "Money Market Placement Meaning"